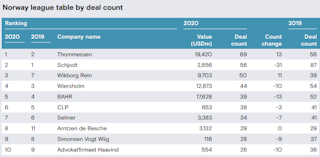

Thommessen ranks as the leading M&A firm by both value and deal count in Mergermarket's 2020 league table for Norway. We secured the top spot having been involved in M&A deals with a total value of 19,420 USDm and with 69 registered transactions. Thommessen was also awarded the Norwegian M&A law firm of the year by Mergermarket.

While the Norwegian M&A market in general contracted significantly in the first half of 2020, our M&A team has been tremendously active and involved in a high number of transactions throughout the year.

- In March 2020, we never dreamed of the spectacular recovery in the second half of the year and that by the end of the year we would have 69 M&A transactions registered in Mergermarket, with a total value of more than 19,420 USDm. We have assisted in significantly more transactions in 2020 compared to 2019, says Christian Grüner Sagstad, head of Thommessen's M&A practice.

Source: Mergermarket Global & Regional M&A Report 2020

Landmark deals

In 2020, Thommessen's projects included, among others, landmark deals such as advising Ebay in the EUR 7,730m sale of its classified business to Adevinta, Autodesk's EUR 202m acquisition of the AI prop-tech company Spacemaker AI, Lyse's hydro-power joint venture with Hydro, as well as a wide range of cross-border and domestic M&A transactions from the venture capital space to the large cap segment.

- Our M&A work in 2020 has shown the importance of being present in the entire spectrum of deal-making, from acting for national and international PE players, to the SME segment, and large industrial firms as well as exciting growth companies. Our assistance to Autodesk in the acquisition of Spacemaker is an example of the strong environment we see of new exciting technology companies in Norway, receiving international attention, says Managing Partner Sverre Tyrhaug.

- We use our expertise and experience from the large and complex deals, to assist effectively and deliver on a budget in smaller M&A transactions and PE / VC investments. At the moment we see a lot of entrepreneurship with several new companies on the rise. Through, among other things, our collaboration with Antler and Katapult Ocean, we can follow these companies from their first investment, and at the same time improve and streamline how we assist them, says partner Ylva Gjesdahl Petersen.

Outlook 2021

The M&A-pipeline for 2021 is looking promising. With positive vaccine news, the market seems to anticipate the end of the pandemic, and we now see that financial sponsors as well as industrial players are positioning themselves for increased M&A activity in 2021. Thommessen is already involved in several projects both on the target, bidder, sponsor and financing side and expects an increase in the general transaction volume in 2021, with sectors such as technology and green energy expected to be particularly active.

- With the strong recovery of the M&A market the recent months and the expectations of life gradually returning to normal during this year, we expect a high level of activity in the first half of 2021, Christian predicts.