In response to China's growing influence in the maritime, logistics and shipbuilding sectors, the United States Trade Representative (the "USTR") has implemented new measures against Chinese operators and Chinese-built ships to counter China's dominance. In terms of vehicle carriers, measures have also been implemented for all "non-US built" vessels.

The measures were implemented by way of a Notice of Action issued by the USTR on 17 April 2025 (the "Notice of Action"). The measures in the Notice of Action include so-called "services fees" which will be phased in already from 14 October 2025 for certain types of vessels (the fees have been set to USD 0 until such time). For some vessels the fees will be increased from 17 April 2026, thereafter on a yearly basis. The measures also include restrictions on the transport of US liquefied natural gas (LNG) which will take effect from 17 April 2028. The USTR has also proposed a tariff on Chinese ship-to-shore (STS) cranes and cargo handling equipment which has not yet been implemented.

Beginning next week and effective as of 14 October 2025:

- A fee in the amount of USD 50 per net ton will have to be paid for an arriving vessel owned or operated by a Chinese entity

- The higher of a fee in the amount of USD 18 per net ton, or USD 120 per container, will have to be paid for each container discharged from an arriving Chinese-built vessel

- A fee in the amount of USD 46 per net ton will have to be paid for an arriving vessel classified as a vehicle carrier or roll-on/roll-off vessel

As a result of input from the industry the USTR issued a Notice of Proposed Modification of certain aspects of the measures in June 2025 (the "June Notice"). The USTR are still reviewing comments from the industry to the June Notice, as such the measures are not yet in their final form.

The measures are complex and as highlighted in our overview below there are a number of uncertainties relating to their scope and effect. What is clear is that the new measures will have a substantial impact on the shipping industry. Careful consideration of current and new set-ups is necessary; for example in terms of financing, existing and new charterparties, management agreements, and so forth. BIMCO has already sought to deal with some of the contractual uncertainties by publishing a standard clause for time charterparties and a guidance in respect of SHIPMAN.

Last week, the US Customs and Border Protection ("CBP") released a new bulletin on the practical aspects of the measures (the "CBP Bulletin"). The CBP Bulletin requires shipowners and operators to classify their vessels as Chinese-owned, Chinese-operated, or Chinese-built and remit the corresponding fee. According to the CBP Bulletin it is the vessel operator, not the CBP, who has the burden of proof in determining and paying the fees before entry at the first US port. Payment is "strongly encouraged" at least three (3) business days in advance of arrival via the Department of the Treasury's secure Pay.gov system. Payments cannot be made at the port of entry. Proof of payment is required for clearance and cargo operations, and without it, vessels may be denied loading or unloading operations, and face delayed release and clearance.

In response to the USTR's measures, China has issued a decree revising its regulations on international maritime transport, effective from 28 September 2025. Under the revised rules, China may impose countermeasures on states or regions that impose or support discriminatory bans or restrictions targeting Chinese maritime operators, vessels or crew involved in maritime transport and related services. These may include imposing special fees on vessels of the relevant country or region when berthing at Chinese ports, or prohibiting or restricting such vessels from entering or leaving Chinese ports. It remains to be seen how the Chinese countermeasures will be implemented and how these will affect the industry.

This newsletter provides a general overview of the new measures as they currently stand for informational purposes only. It does not constitute legal advice as Thommessen is not US qualified. Where questions of US law arise Thommessen will cooperate with qualified US counsel. Thommessen is continuously monitoring the developments and the implications of the new measures for the shipping industry and remain available to help clients navigate the changing legal landscape, including by coordinating with US counsel when needed.

Overview of the USTR's measures

The measures include:

- Annex I: Fees on Chinese vessel operators and vessel owners

- Annex II: Fees on vessel operators of Chinese-built vessels

- Annex III: Fees on vessel operators of foreign-built vehicle carriers

- Annex IV: Restrictions on US LNG transport

- Annex V: Tariffs on Chinese STS cranes and cargo handling equipment

From 14 October 2025, the calculation of fees under Annexes I, II and III will be based on net tonnage, or for certain types of vessels, on a fee per container if this results in a higher fee amount, or per car equivalent unit (although the latter is likely to also change to net tonnage as per the June Notice). It is not yet clear how a vessel's net tonnage will be calculated across ports in the US, however, as of the date of publishing this newsletter, Port Houston has issued guidance on its interpretation of the legal framework (see further below).

For vessels on charterparties it is important to consider which party will be contractually liable for the fees under Annexes I to III. Under most standard form time charterparties this would arguably be the charterers whilst under standard form voyage charterparties it could arguably be the owners. For new charterparties clear provision should be made in terms of liability for potential fees.

The standard clause adopted by BIMCO for time charterparties addresses fees under Annexes I and II and may be incorporated into both new and existing time charterparties. Under the clause the fees are generally the responsibility of the charterers, except where the fees arise as a result of for example the owners' failure to declare, an inaccurate declaration, change of registered owner, bareboat charterer, managers or vessel operator, or as a result of the owners' breaches of the charterparty, off-hire events, or use of the vessel outside of the charterers' instructions.

A vessel will only be subject to one of the Annexes, either one of the three fees under Annexes I to III or a requirement under Annex IV. The fees and requirements are assessed in the following order:

- Annex IV: Restrictions on US LNG transport

- Annex III: Fees on vessel operators of foreign-built vehicle carriers

- Annex I: Fees on Chinese vessel operators and vessel owners

- Annex II: Fees on vessel operators of Chinese-built vessels

In a non-binding guidance issued by the CBP on 3 October, it was clarified that LNG vessels are exempt from the Annex I – Annex III fees.

Fees on Chinese-owned, Chinese-operated, Chinese-built vessels and non-U.S. built Vehicle Carriers (Annexes I,II and III) are imposed up to five times per vessel per year. It has been unclear when the one year time period will run from, i.e. if it runs based on a calendar year, from the date of the Notice of Action or some other point in time. In the modifications announced by USTR 10 October 2025, it was stated that the fees under Annex III are imposed up to five times per calendar year, per vessel. This suggest that the same may be applied for Annex I and II.

There are no fees related to the composition of the owner's or operator's fleet; the emphasis is solely on the relevant vessel and its owner/operator.

Details of Annexes I-V

1. Annex I: Fees on chinese vessel operators and owners

Fees are imposed for vessels operated by Chinese entities or owned by Chinese entities entering US ports. The definition of what will be considered a "Chinese" vessel owner or vessel operator is very broad and will encompass owners and operators who are registered or headquartered in China (being the People's Republic of China, Hong Kong and Macau) or any entity which is controlled by or subject to the jurisdiction of China.

The vessel operator is the entity identified as the operator of the vessel, whose name appears on the Vessel Entrance or Clearance Statement (CBP Form 1300). CBP Form 1300 is a form used by the CBP to document the arrival and departure of vessels at US ports.

According to the notes to this form, the "operator" is the party listed on the Certificate of Financial Responsibility (Water Pollution) unless other verifiable charter or lease arrangement indicates otherwise. For most vessels there are a number of parties who could be considered the "operator". For example bareboat charterers, technical managers, commercial managers or long-term time charterers.

As the fees are payable by the vessel operator, it is important to carefully consider the party included in CBP Form 1300. Although parties are generally free to decide who to list as "operator", the CBP may verify and check the information on the form. Should the technical manager be listed as operator and as such assume the responsibility for the fees this might require changes to the management agreement.

The vessel owner is also defined as the entity identified as the owner of the vessel in CBP Form 1300. CBP Form 1300 provides no further definition of "owner". The CBP may also in this respect verify and check the party listed.

Given the broad definition of "Chinese" and the unclear definition of "vessel owner" it is possible that vessels financed through Chinese sale-leaseback arrangements may at least in certain cases fall under the scope of Annex I. It is also possible that vessels which are registered in Hong Kong but with foreign owners will be included within its scope. However, no guidance has so far been provided on these issues.

Fee schedule:

The fee can be charged up to five times per year, per vessel.

Exceptions:

There are currently no exceptions or carve outs to the scope of Annex I.

2. ANNEx II: Fees on vessel operators of chinese-built vessels

Fees have been implemented for Chinese-built vessels based on either (1) the net tonnage of the vessel or (2) a fee per container, applying the higher of the two. In terms of what is considered a "container" there does not seem to be a difference between different sizes of containers.

The fees will be payable by the vessel owner. The fee will be imposed on the entry of a Chinese-built vessel into a US port. If a vessel enters the US multiple times before transiting to a foreign destination, this fee will be applied per rotation or string of US port calls. Port calls refer to the arrival of vessels at ports in the US for various activities, including loading or unloading cargo, although it is not clear whether it will also include calls to US ports for activities such as bunkering, obtaining supplies, carrying out repairs etc.

Fee schedule:

The fee can be charged up to five times per year, per vessel.

Exceptions:

Operators can receive a fee remission for up to three years if they order and take delivery of a US-built vessel of equivalent or greater capacity within that time.

In terms of what will be considered "US-built" for Annex II and the exceptions in Annex III and IV, this will include vessels with all major equipment manufactured in the US. The proposal also includes a list of components which, if manufactured in the US, will mean that a vessel is considered "US-built".

The fees do not apply to US government cargo or certain Chinese-built vessels, including amongst other:

- US-owned or US-flagged vessels enrolled in various security programs

- vessels arriving empty or in ballast

- vessels with a capacity of up to 4 000 twenty-foot equivalent units, 55 000 deadweight tons, or 80 000 deadweight tons for bulk

- vessels entering a US port from a voyage of less than 2,000 nautical miles from a foreign port

- US-owned vessels controlled and at least 75% owned by US persons

These exceptions do not apply to the fees on Chinese owners and operators (Annex I).

3. ANNEX iii - fees on vessel operators of foreign-built vehicle carriers

A fee has also been implemented on vessel operators of foreign-built vehicle carriers, again as specified in CBP Form 1300. This will include all vessels not built in the US, although a vessel will be considered US built if all major components are manufactured in the US.

Effective 14 October 2025, a fee of USD 46 per net ton will apply to non-US built vehicle carriers. This latest development was announced on 10 October 2025 and is a significant increase of the original port fee proposal by USTR in June of USD 14 per net ton. In the June Notice it was also clarified that a "vehicle carrier" will include roll-on / roll-off vessels.

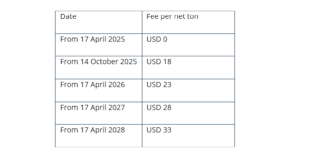

In the modification issued by the USTR on 10 October 2025, the following revised fee schedule was announced:

The fee can be charged up to five times per calendar year, per vessel.

Exceptions:

The fee will be suspended for up to three years if the vessel owner orders and takes delivery of a US-built vessel of equivalent or greater CEU capacity. Owners are eligible for remission from the time of order until delivery of the US-built vessel. An equivalent non-US-built vessel is one with a CEU capacity equal to or less than the US-built vessel ordered.

If the owner does not take delivery within three years, the fees become due immediately. Proof of the order must be provided on demand and may include order and contract information. The same suspension does not apply to vessels owned or leased by Chinese entities.

The exceptions to Annex II do not apply to Annex III, however, two exceptions apply for vehicle carriers subject to Annex III US-owned or US-flagged vessels enrolled in the Maritime Security Program, and US Government vessels, are exempt from these fees until at least 18 April 2029. The USTR also proposes to add a third exemption for US-flagged vessels of up to 10,000 DWT and invites public comments on this point by 10 November 2025.

4. Annex IV: Restrictions on us lng transport

Further, the proposal imposes a measure to require the use of the US vessels for the maritime transport of a certain percentage of LNG exports after three years.

Starting 17 April 2028 a percentage of LNG exports must be transported by US-built, US-flagged, and US-operated vessels. This percentage will increase annually, starting at one percent and rising incrementally each year by one to two percent, reaching fifteen percent by 17 April 2047.

Under the Notice of Action the USTR could direct the suspension of LNG export licenses if the restrictions were not to be met. In the June Notice it has been proposed to remove this suspension in order to allay concerns about the provision's impact on the US LNG sector.

Under the Notice of Action it is the LNG terminals which are obliged report LNG shipments, and percentage of LNG shipped, on US flagged, US built and US operated vessels. The June Notice proposes to shift this reporting obligation to vessel operator, stating that the vessel operator must report the amount of maritime LNG exports carried on US built and US operated vessels and the amount of LNG carried on foreign-built and foreign-operated vessels.

Exceptions:

A vessel operator can obtain a license to operate non-compliant LNG vessels for up to three years, provided that they order and take delivery of a US-built LNG vessel of equivalent or greater capacity within that period.

Annex v: Tariffs on chinese sts cranes and cargo handling equipment

The USTR has also proposed certain additional duties on various products "of China", specifically targeting STS cranes and cargo handling equipment, ranging from 20% to 100%, depending on the product category. This will include products with certain major components originating from China and products that have transited through, or have been stored, in China. It is the importer who must demonstrate that the product is not "of China".

A public hearing was held on 19 May 2025 on Annex V. The USTR has not issued anything further on Annex V since then.

Port Houston's trade information notice

In a trade information notice issued on 6 October 2025, Port Houston provided some guidance on the implementation of the fees. This guidance will only apply to the ports in the Houston/Galveston area, and we do not know how other US ports will implement the new fees.

Annex I

- The vessel owner(s) will be determined by the vessel's registry.

- The vessel operator will be verified through review of the Certificate of Financial Responsibility, but other documents such as a Bridge Letter or Continuous Synopsis may be requested.

- The vessel's net tonnage will be determined based on the vessel's International Tonnage Certificate.

Annex II

- The fees for Chinese-built vessels will be applied for vessels built in the People's Republic of China which are not subject to Annex I fees and not otherwise exempt.

- The vessel's registry data will be used to determine where the vessel was built.

- The measure as to who many containers have been discharged will be determined by figures transmitted on applicable electronic cargo declarations (e.g. bills of lading)

Annex III

- Port Houston notably states it will apply fees based on the net tonnage (not on the Car Equivalent Units). The USTR has not as of yet formally modified its original notice which refers to Car Equivalent Units.